Medium-term management plan

In May 2023, our group announced the "New medium-term management plan (FY2023-FY2025)". In May 2024, we formulated and announced a new 5-year medium-term management plan for the content and digital business segment based on current conditions.

PS business segment is steadily implementing and growing in line with the new medium-term management plan (FY2023-FY2025). The group is considering a new medium-term management plan based on the consolidation of Sophia group and changes in the market environment.

*Click the image to enlarge

Content and digital business segment 5-year new medium-term management plan (FY2024-FY2028)

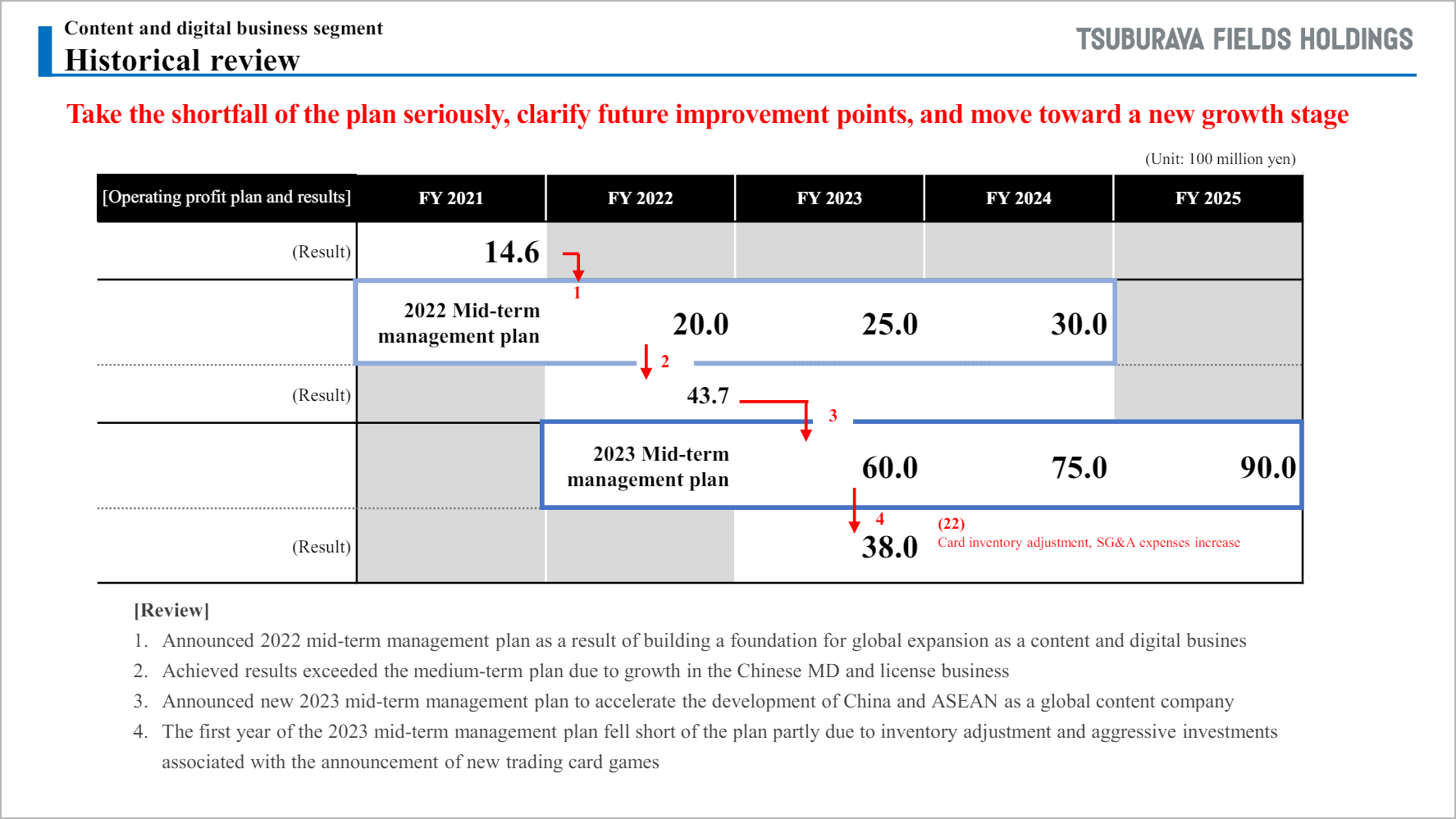

Historical review

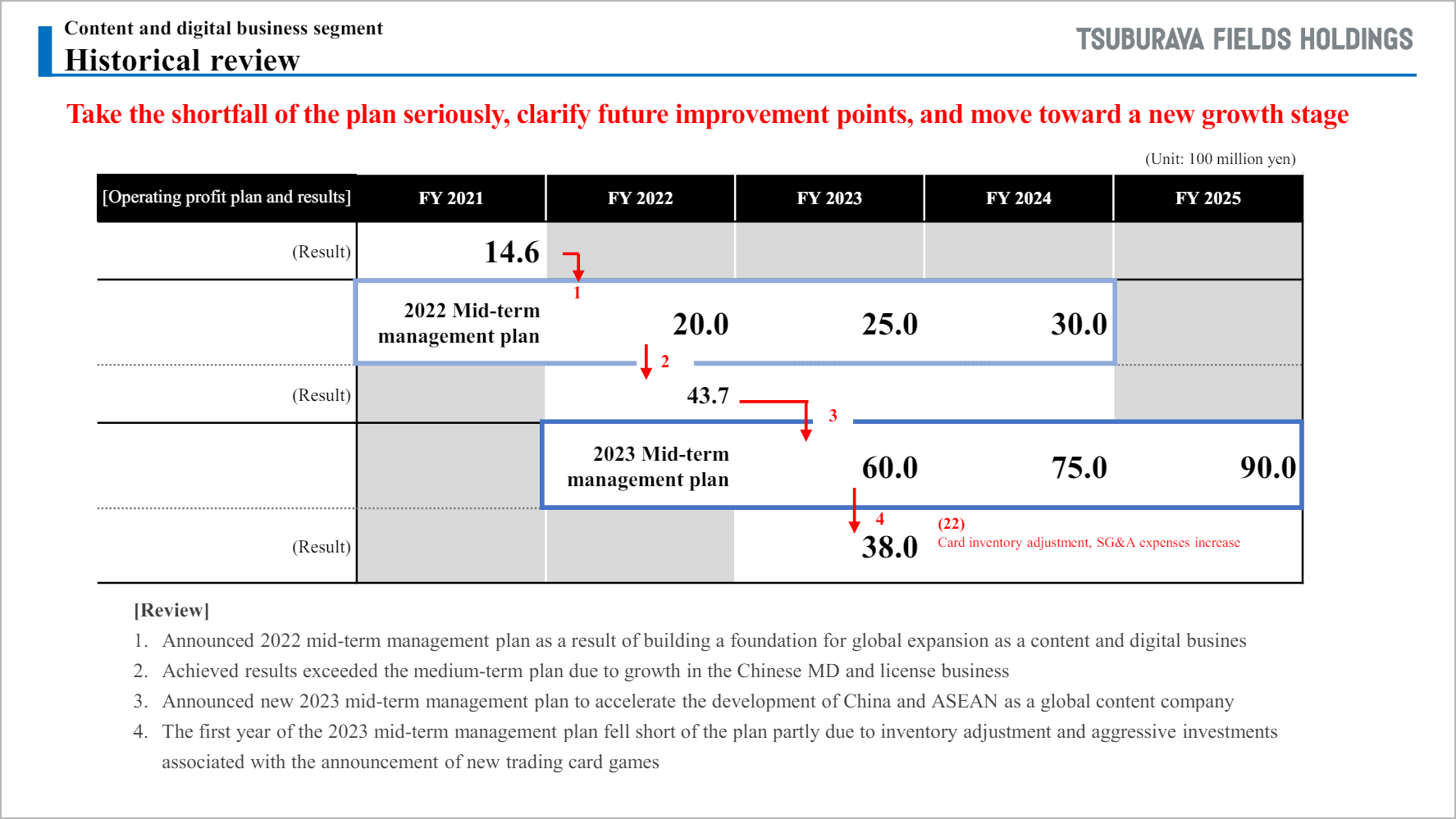

Chart below shows the operating profit forecasts and results for the contents and digital business segment.

As a historical review, in the FY2021, the segment's operating profit was ¥1.46 billion, which was a record high for the time.

In this response, the company announced the 2022 medium-term management plan to accelerate global expansion and announced a three-year operating profit plan (see (1) in the chart). The company planned ¥2 billion for the first year, but this was ¥4.37 billion due to growth in the Chinese MD and license business in particular (see (2) in the chart).

In response to the fact that it greatly exceeded the plan from the first year of the medium-term management plan, the Company announced a new medium-term management plan for 2024 and beyond, and a three-year operating profit plan (see (3) in the chart).

In the FY2023, as a result of temporary inventory adjustments of existing card games and active investment, operating profit was ¥3.8 billion compared to the ¥6 billion plan (see (4) in the chart).

We take this outcome seriously and announce plans to move toward a new growth stage by clarifying areas for improvement in the future.

Outline of the 5-Year New Medium-Term Management Plan

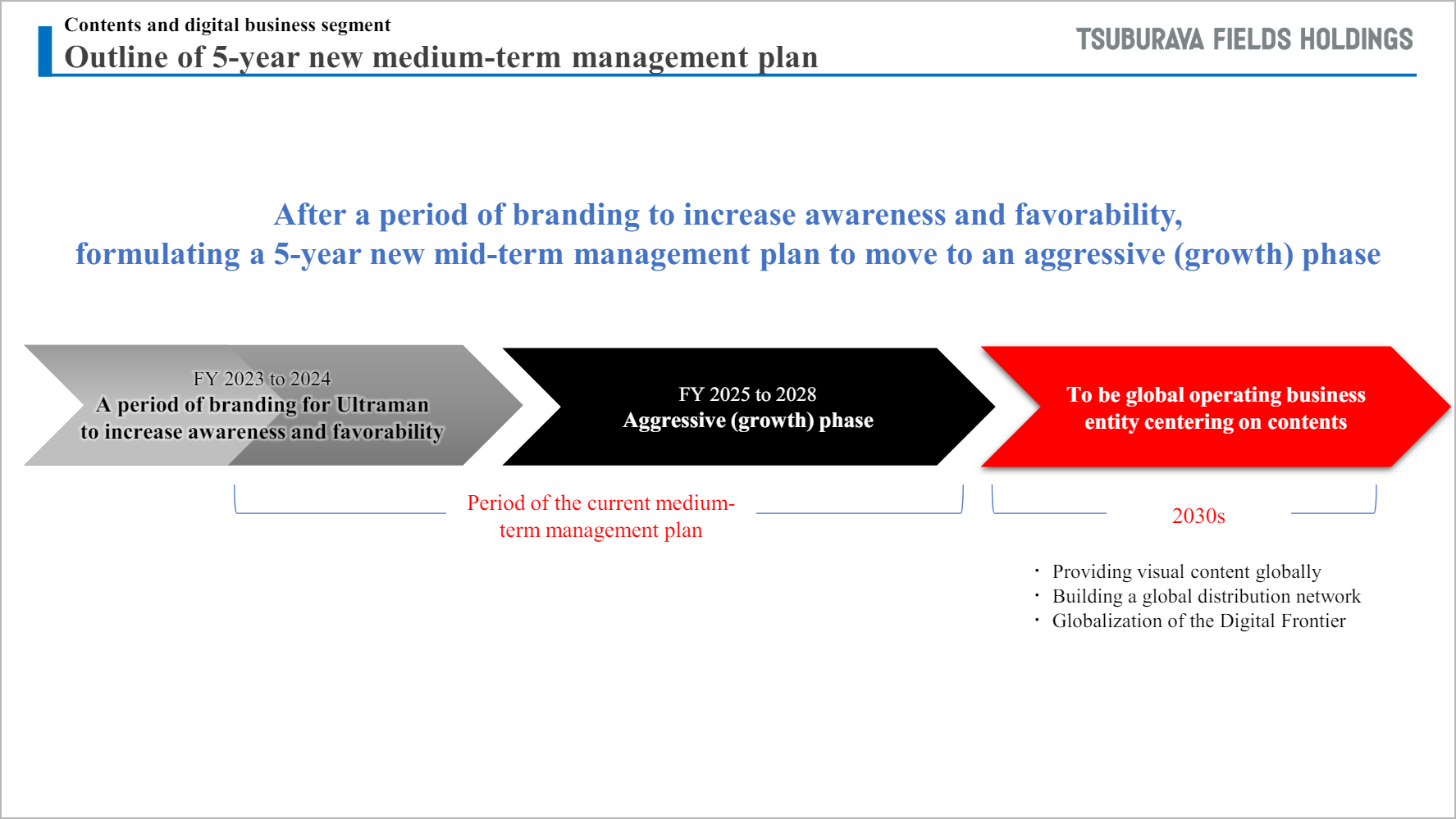

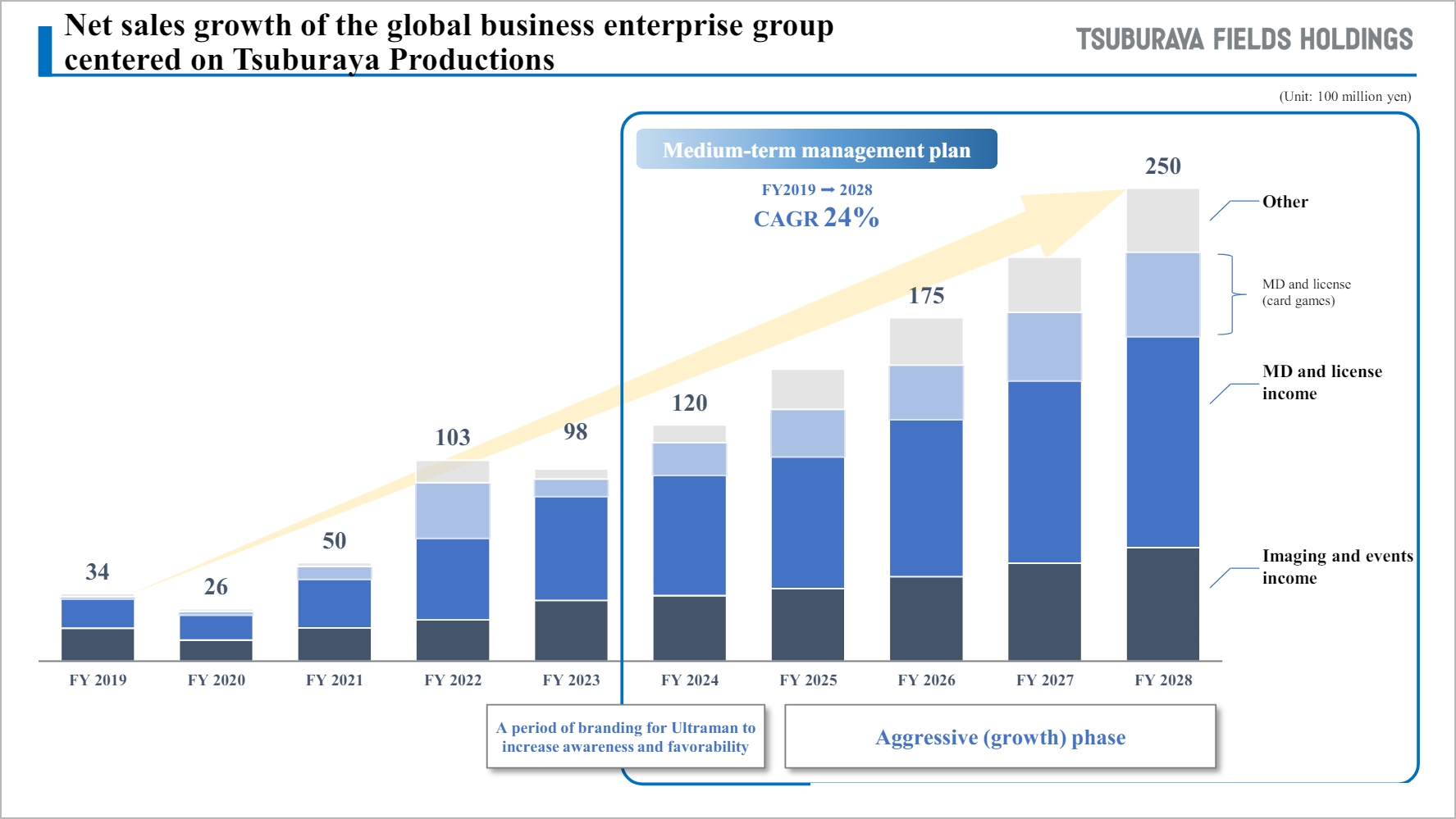

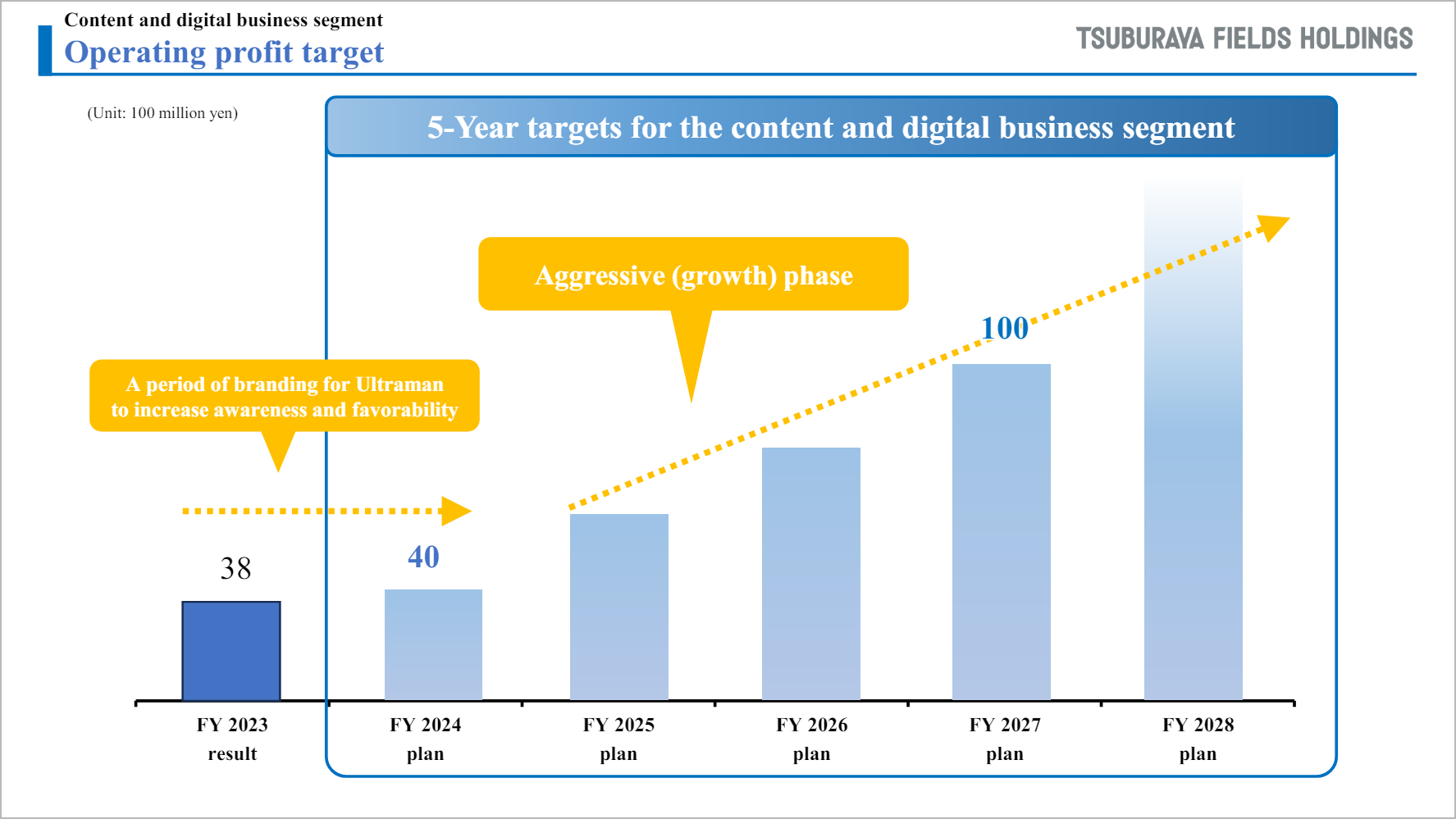

The previous fiscal year (FY 2023) and the current fiscal year (FY 2024) will be positioned as a thorough branding period to increase awareness and favorability, and to lay the groundwork for growth.

From FY2025, the company hopes to enter an aggressive growth phase.

Thereafter, the company aims to become a globally dynamic business entity based on a variety of content.

Growth potential of Tsuburaya Productions, Stable Growth of B2B Businesses, and change and growth to new business models

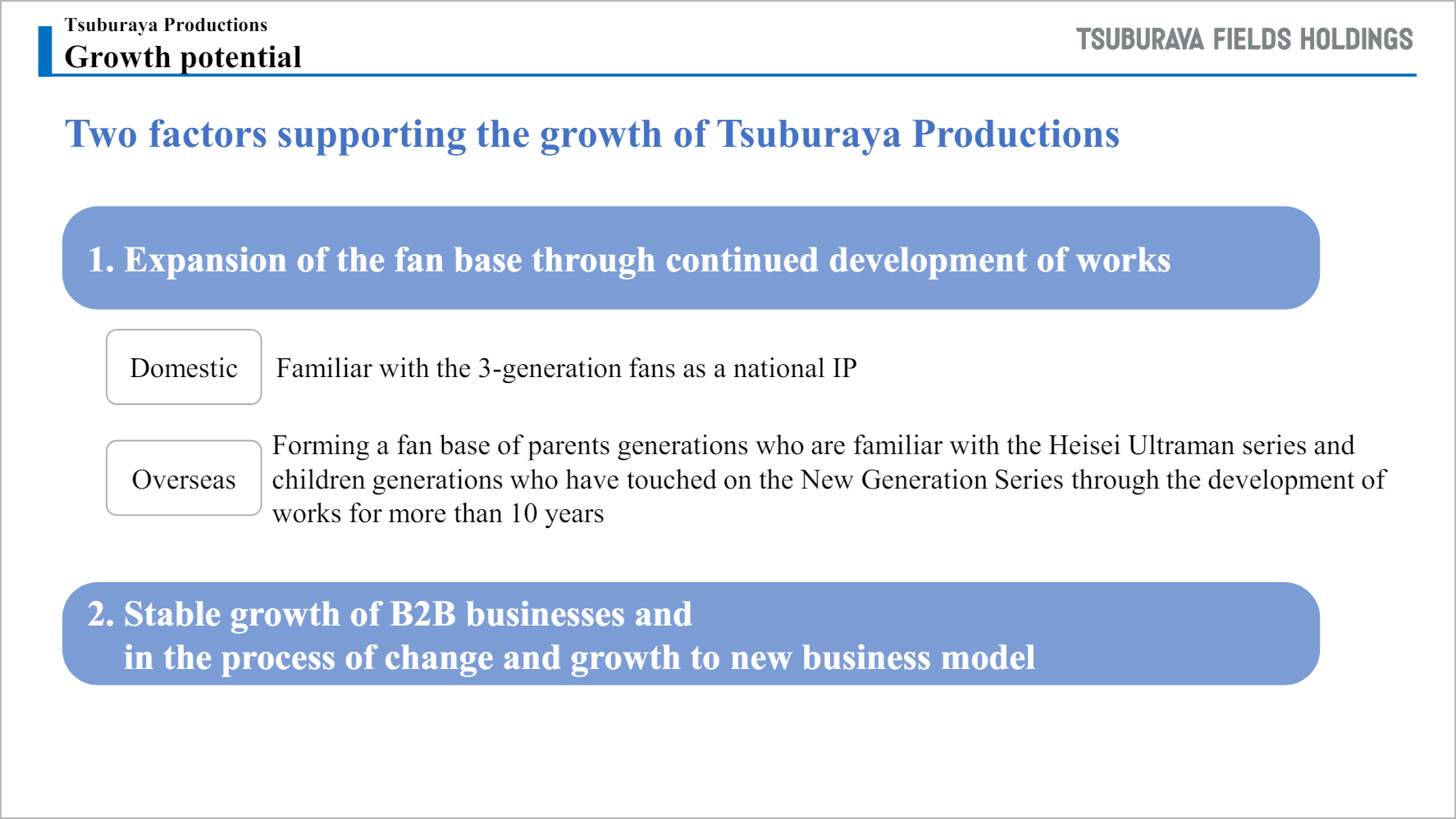

The first major factor supporting the growth of Tsuburaya Productions is the steady expansion of the fan base through continued product development. In Japan, three-generation fans are familiar. In overseas, particularly in China and other Asia countries, the development of over 10 years of TV series and other works has produced results, creating a very strong fan base centered on parents in their 30s and their children who have grown by viewing popular works such as Ultraman Tiga.

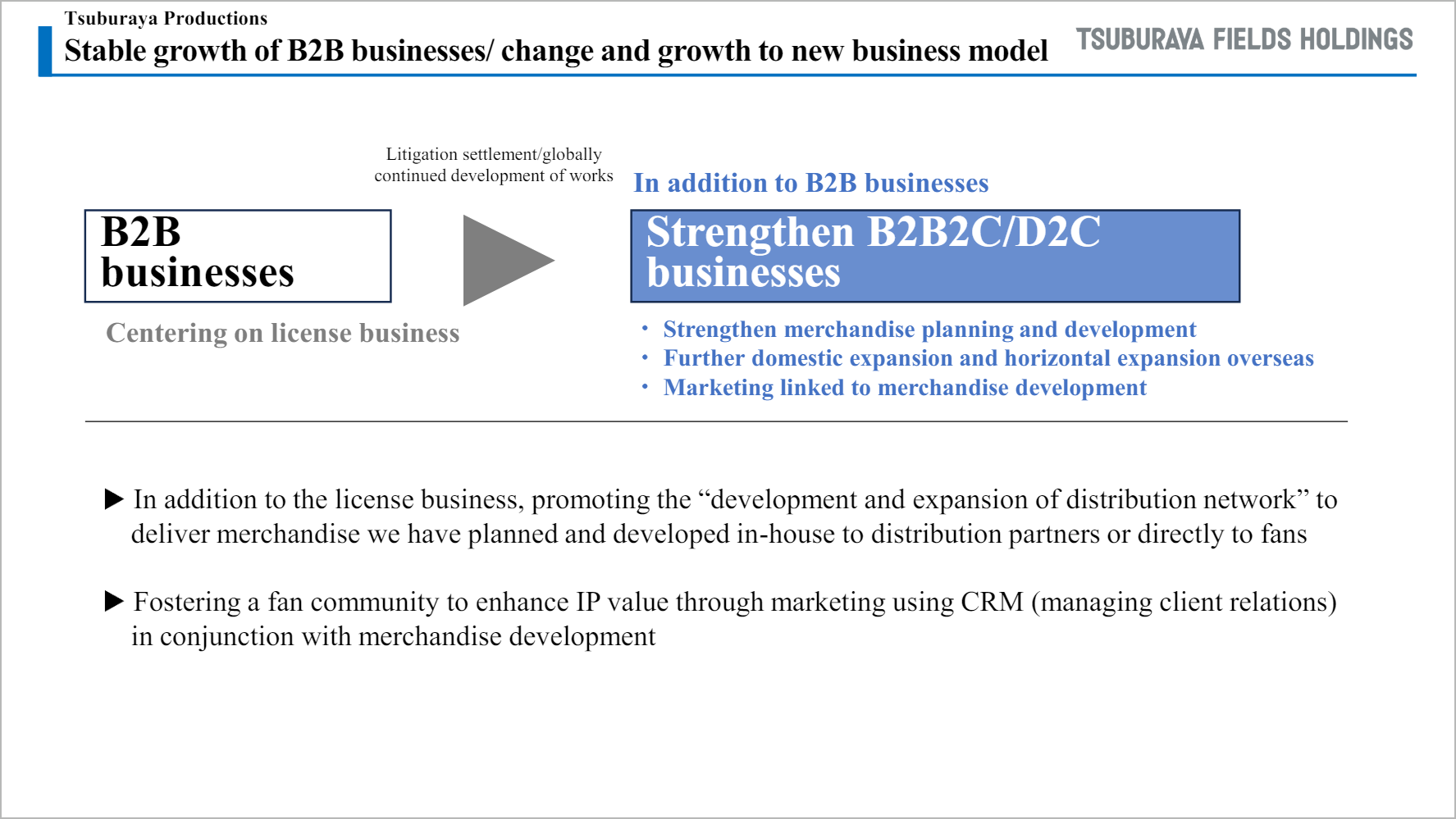

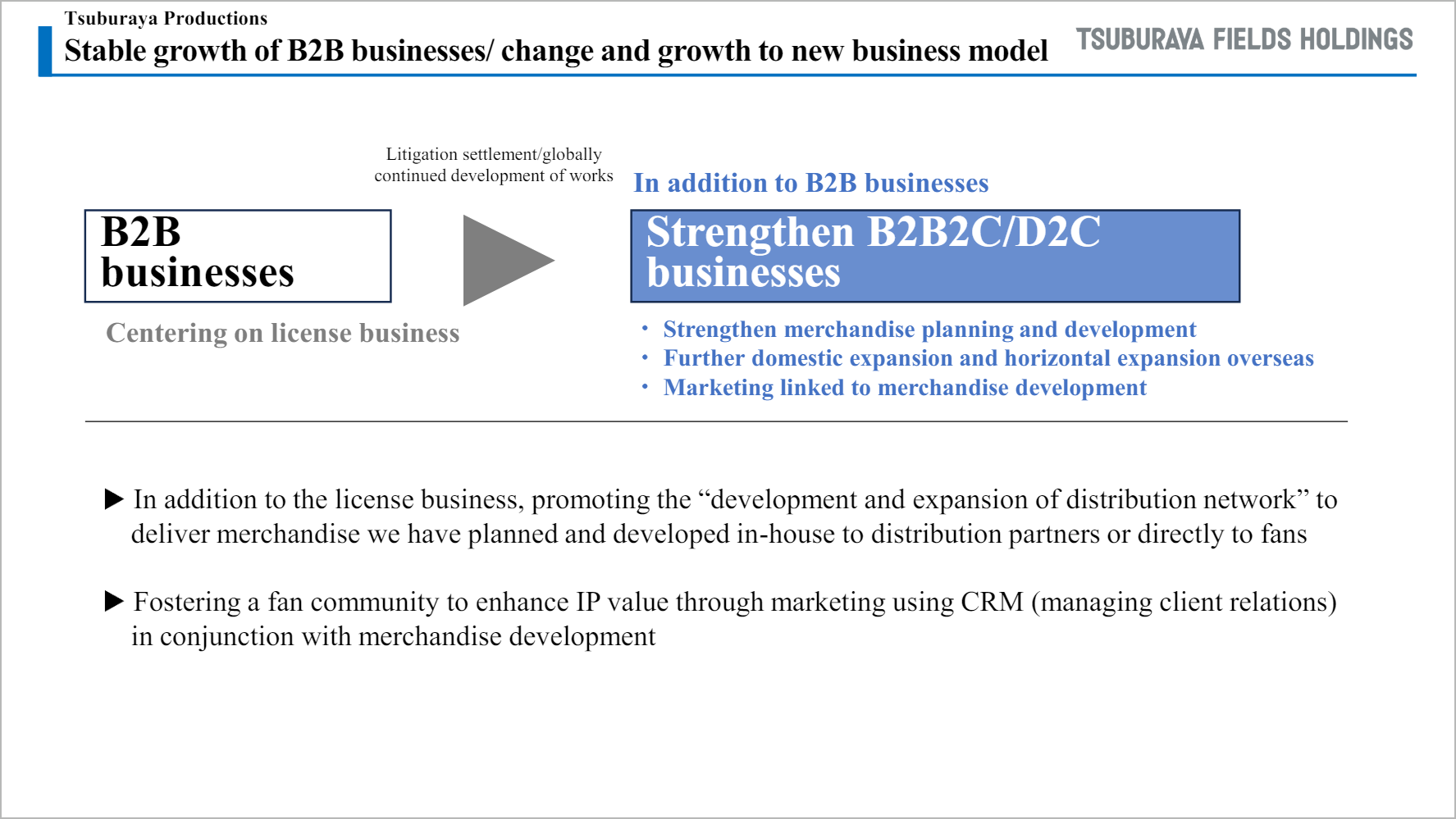

Second, Tsuburaya Productions is reforming its business model and is in the process of changing and growing to a new business model in addition to a stable growth model for B2B businesses. In addition to B2B businesses (mainly royalty income and licensing business revenues), the company is strengthening its B2B2C and D2C businesses as a business to expand globally. Currently, the company is in the midst of strengthening merchandise planning and development, further domestic expansion and cross-overseas expansion, and marketing in conjunction with merchandise development.

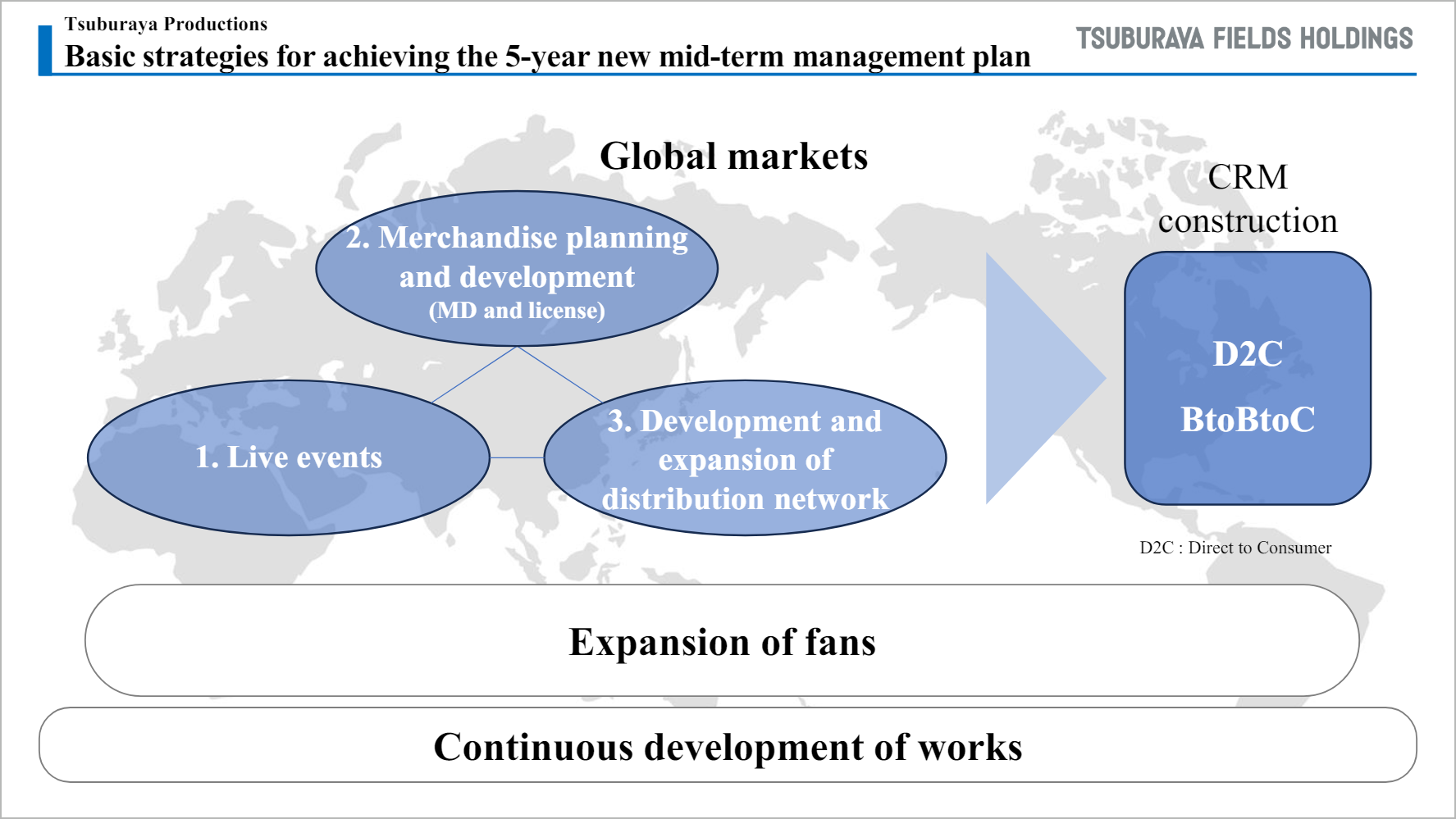

Basic strategies for achieving the 5-Year new medium-term management plan

The company is promoting the development and expansion of distribution networks to deliver to each distribution partner or directly to fans. In addition, through marketing that utilizes CRM linked to Merchandise development, the company is further enhancing IP value and fostering communities. The company is currently building the flow of “1 Live events, 2 Merchandise planning and development, and 3 Development and expansion of distribution network” in order to expand the number of fans through the continuous development of the global market it serves.

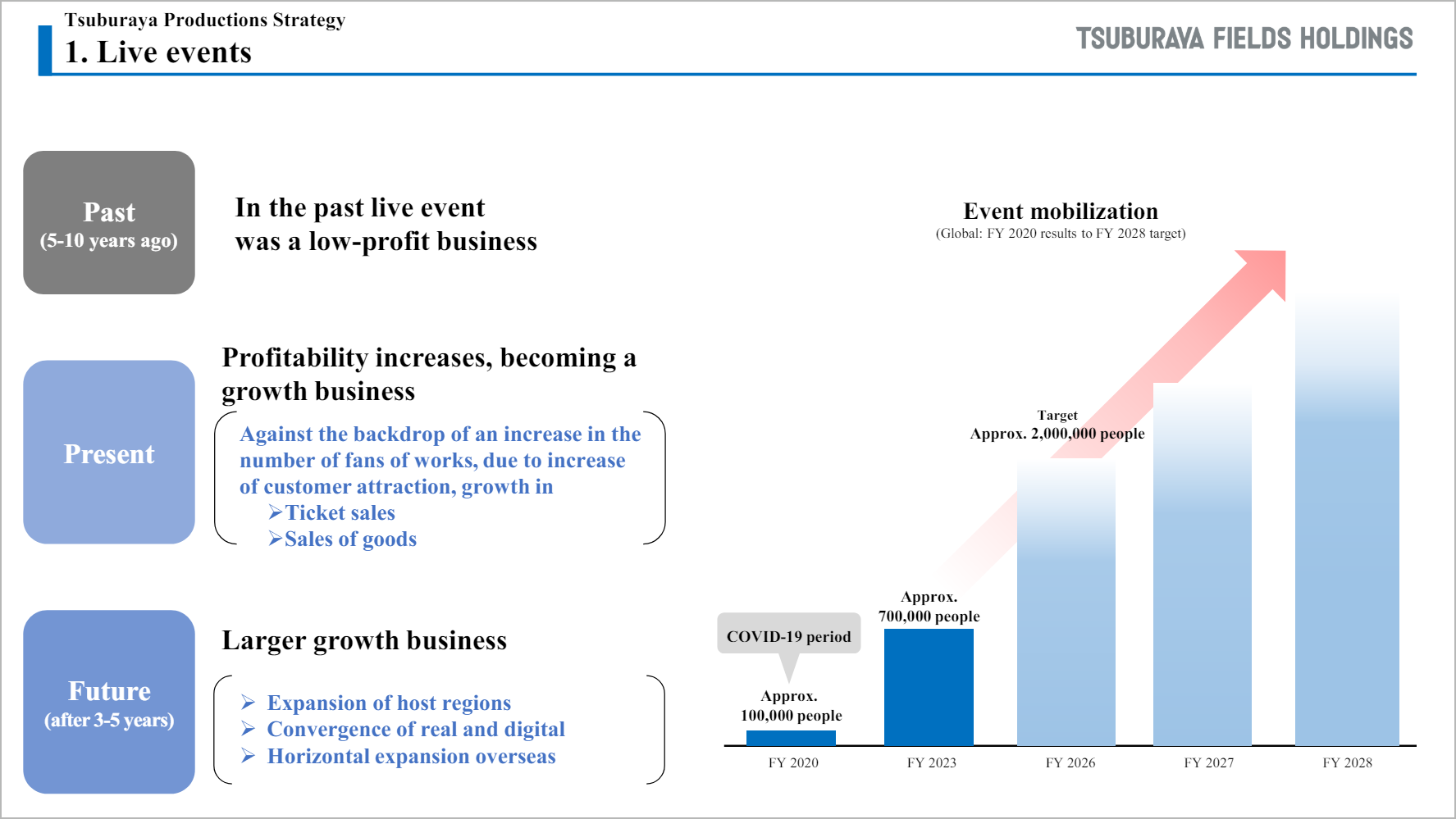

Tsuburaya Production strategy (1. Live events)

The past live event business was conducted only domestically, and it was a very low-profit business. The COVID-19 pandemic had an extremely difficult situation with evens attendance of around 100,000 customers per year. However, the company changed its approach and implemented various measures to attract as many as 700,000 visitors. Ticket sales and product sales accompanying this have been extremely strong and are steadily expanding. We think there is plenty of room for growth, and in addition to the traditional Tokyo hosting of large-scale summer events, we plan to hold these events in Osaka from this year. In overseas, the company is also working to expand horizontal expansion using similar know-how.

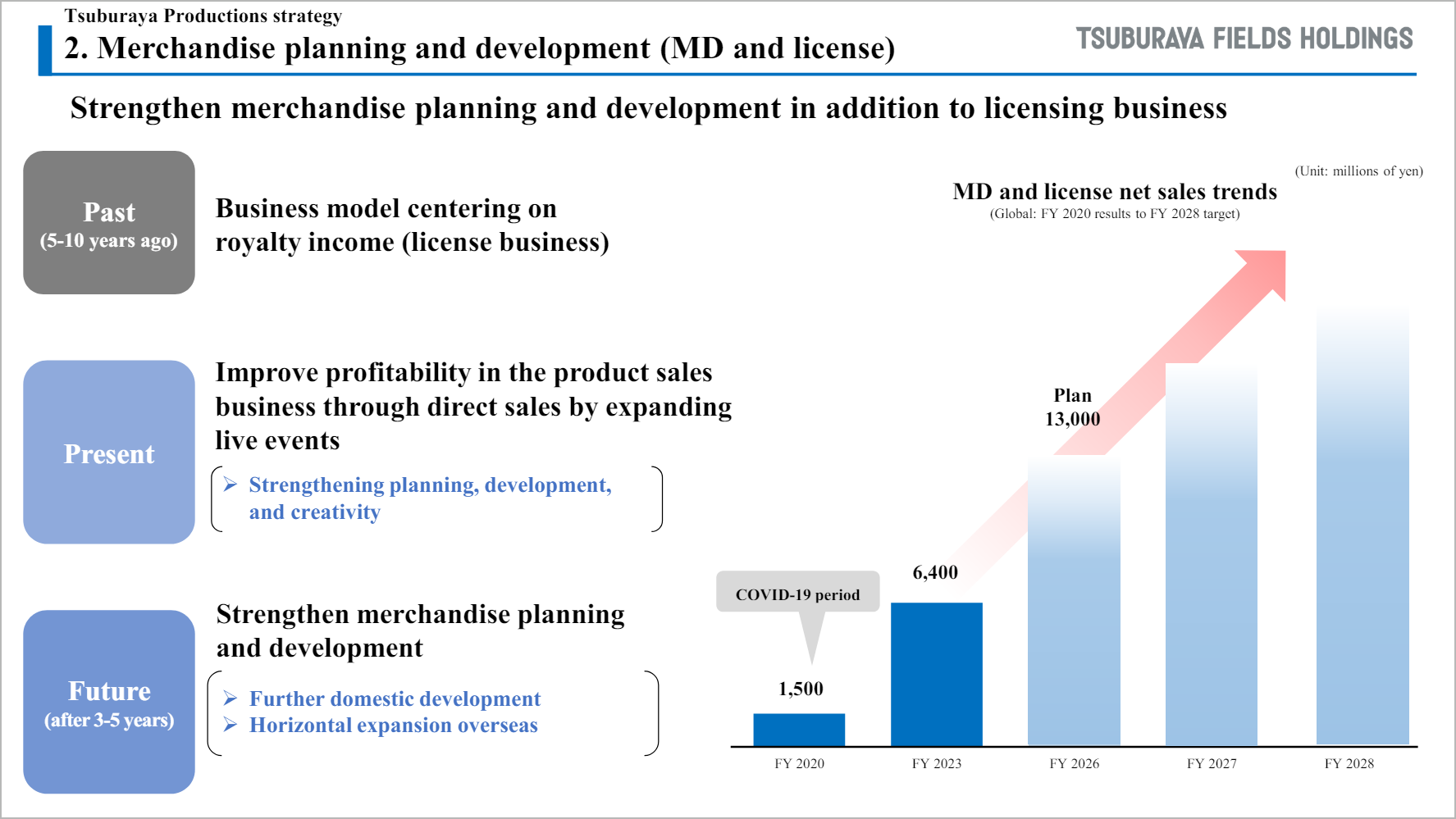

Tsuburaya Productions Strategy (2. MD and license)

In addition to the licensing business, the company is strengthening its merchandise planning and development. The expansion of live events enables the company to deliver merchandise planned and developed in-house to direct fans at the venues. Growth in terms of strengthening merchandise planning and development is ample, and further expansion in the domestic market and horizontal expansion in the overseas market are expected. Sales of MD and license, which were ¥1.5 billion as of FY2020, are projected to exceed ¥6.4 billion in FY2023 and ¥10 billion in the future.

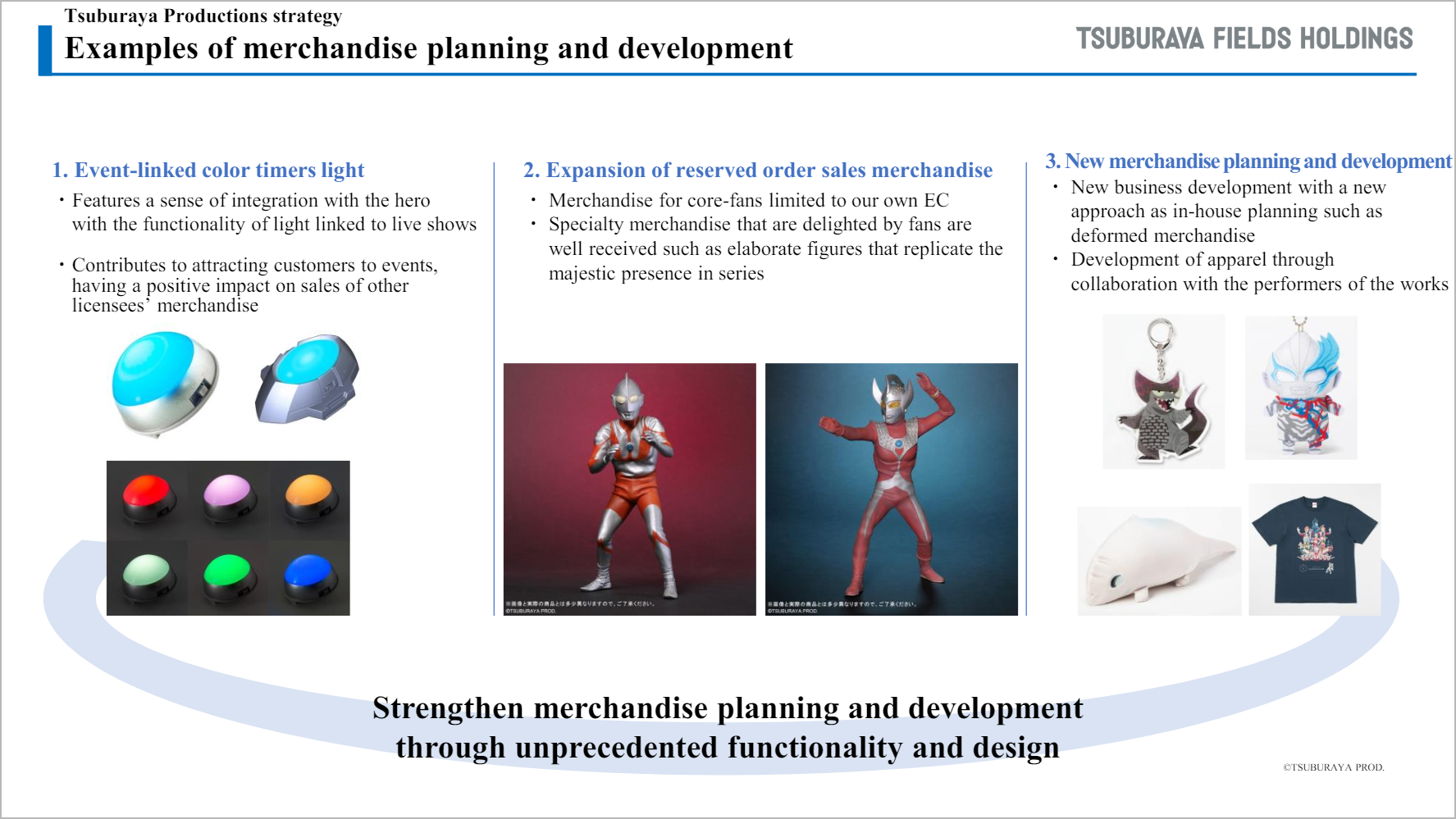

Examples of merchandise planning and development

An example of event-linked merchandise is “color timers," which are merchandise that customers who come to the event always buy so much.

In addition, in the e-commerce website of Tsuburaya Store, which we have developed independently, we are developing a variety of merchandise, including limited merchandise and collaborative merchandise through order-based sales. Due to merchandise categories and patterns that have not yet been launched, it is planned to be expanded in the future.

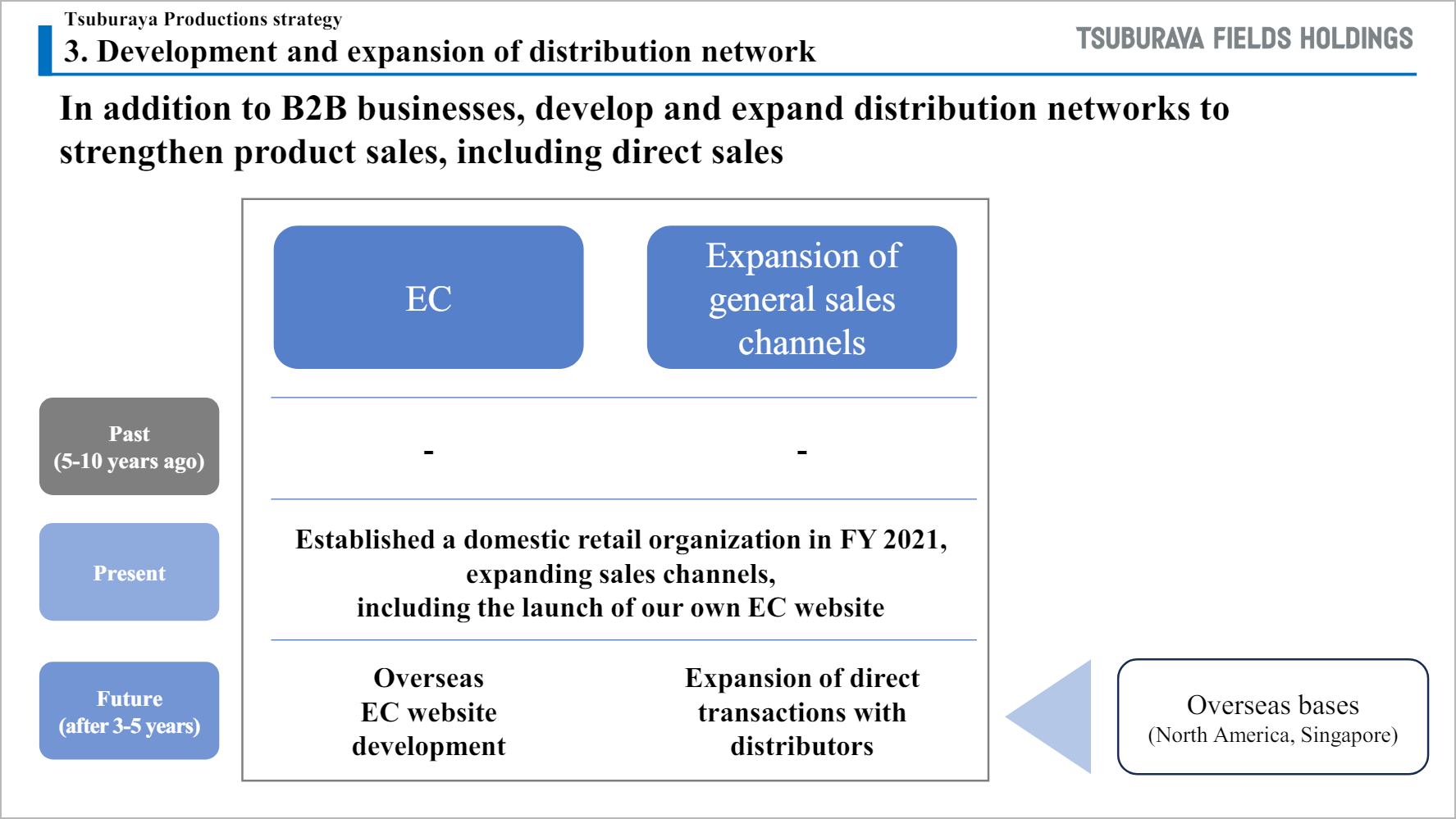

Tsuburaya Productions Strategy (3. Development and expansion of distribution network)

The company established a domestic retail organization in FY2021 and is working to expand its general sales channels. Domestically, the company launched the TSUBURATA STORE ONLINE on its own website. The company has also begun planning measures to expand the number of fans in cooperation with major retailers, and has begun activities to expand the sales floor by developing these measures with the cooperation of each licensee. Looking ahead, the company will work to develop and expand its distribution network, focusing on two bases in North America and Singapore.

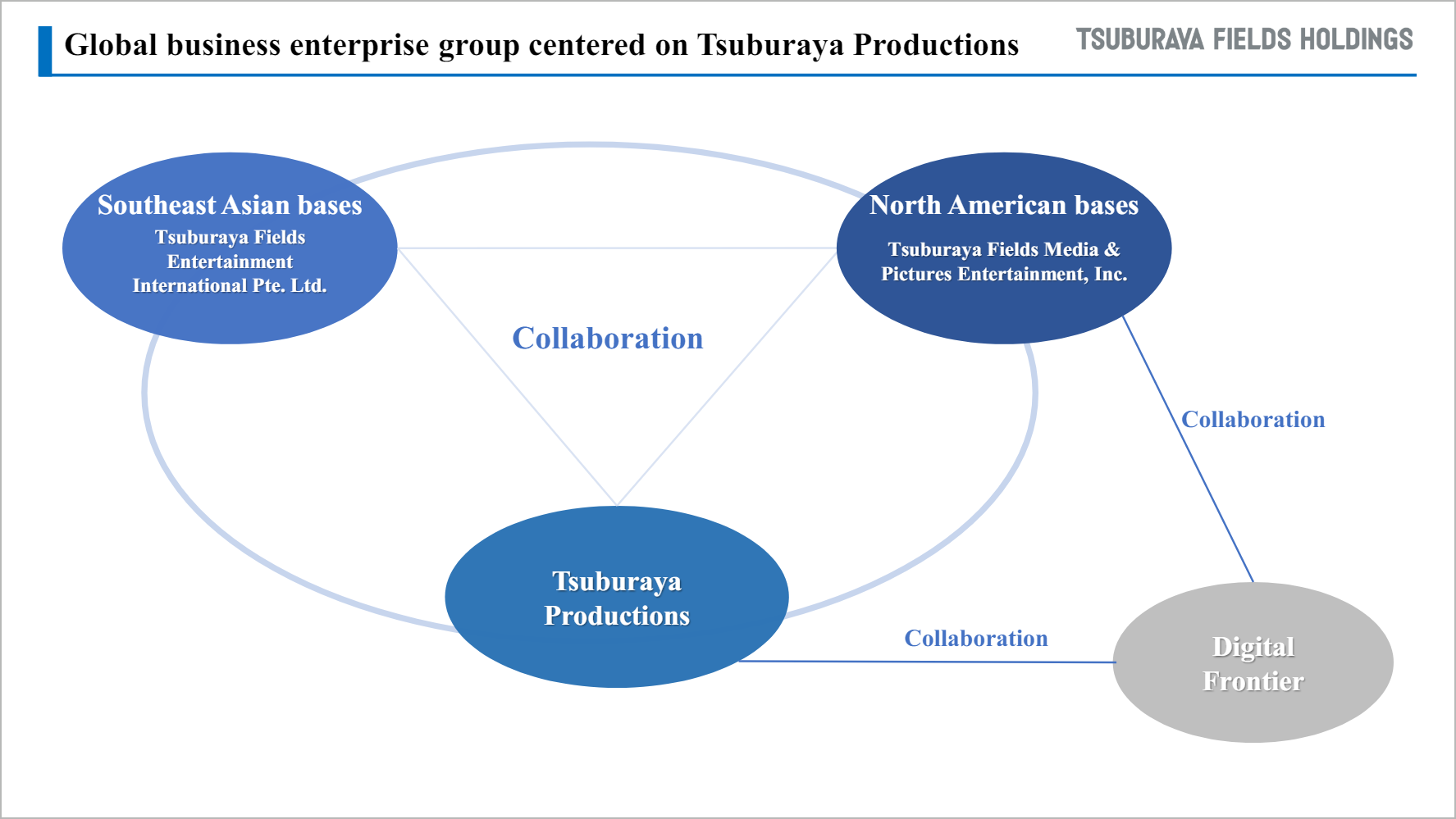

Global business enterprise group centered on Tsuburaya Productions

With Tsuburaya Productions at its core, the North American base Tsuburaya Fields Media & Pictures Entertainment, Inc., Singapore-based Tsuburaya Fields Entertainment International Pte. Ltd., and the Group-based Digital Frontier will work together to engage in global businesses.

Net sales growth of the global business enterprise group centered on Tsuburaya Productions

In terms of net sales growth among global business companies, revenues from events and related MD and license revenues from the development of visual products are steadily growing on a baseline basis.

Going forward, along with the rollout of new merchandise lineups, including card games, we will steadily grow the various merchandise categories.

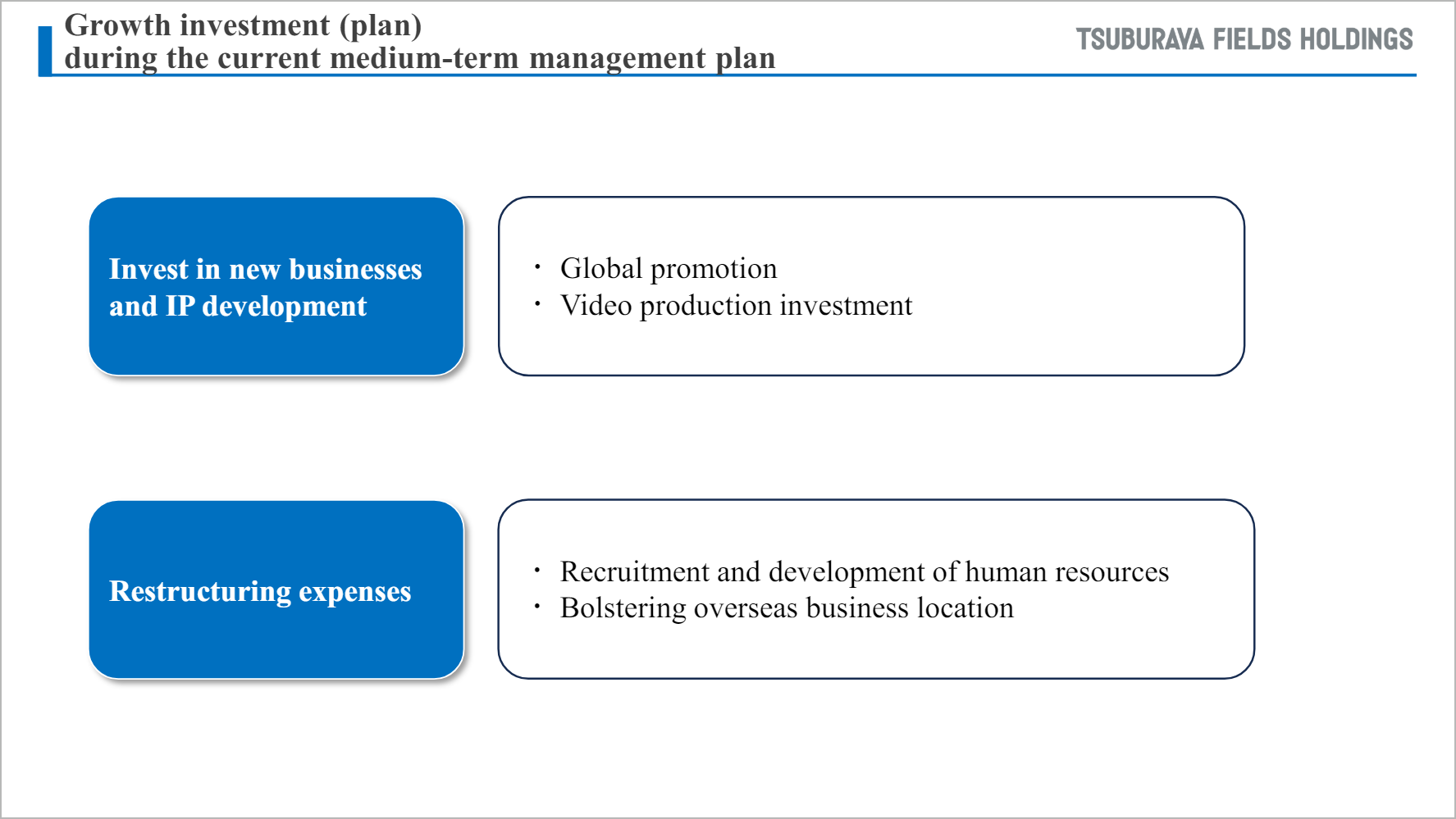

Growth investment (plan) during the current medium-term management plan

During the period of the current medium-term management plan, the company will invest in new businesses and IP development, as well as structural reforms, with a view to achieving further growth. In the next fiscal year (FY 2024), the Company will focus on global promotional activities in line with the development of card games and new merchandise lineups, and will continue to invest a certain amount in the future. The company will also invest in video production, acquire and develop human resources in line with structural reforms, and strengthen its overseas bases.

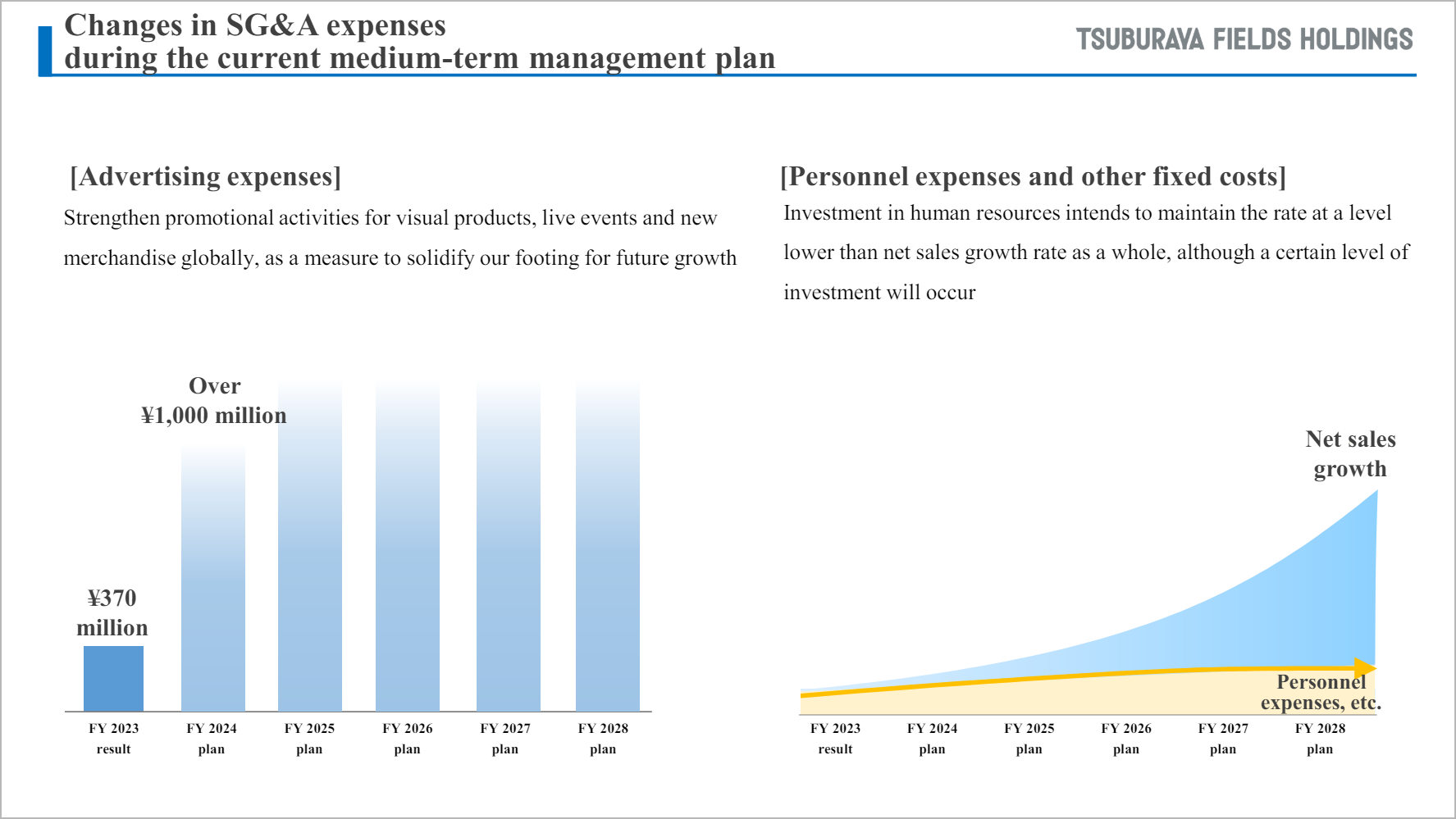

Changes in selling, general and administrative expenses during the current medium-term management plan

The current fiscal year’s advertising expenses totaled ¥370 million, but in FY 2024 the company will aggressive invest more than ¥1 billion for thorough branding.

This will lead to new developments by branding, such as acquiring awareness of a wide range of targets. The company's policy is to maintain other fixed costs at a level below net sales growth rate.

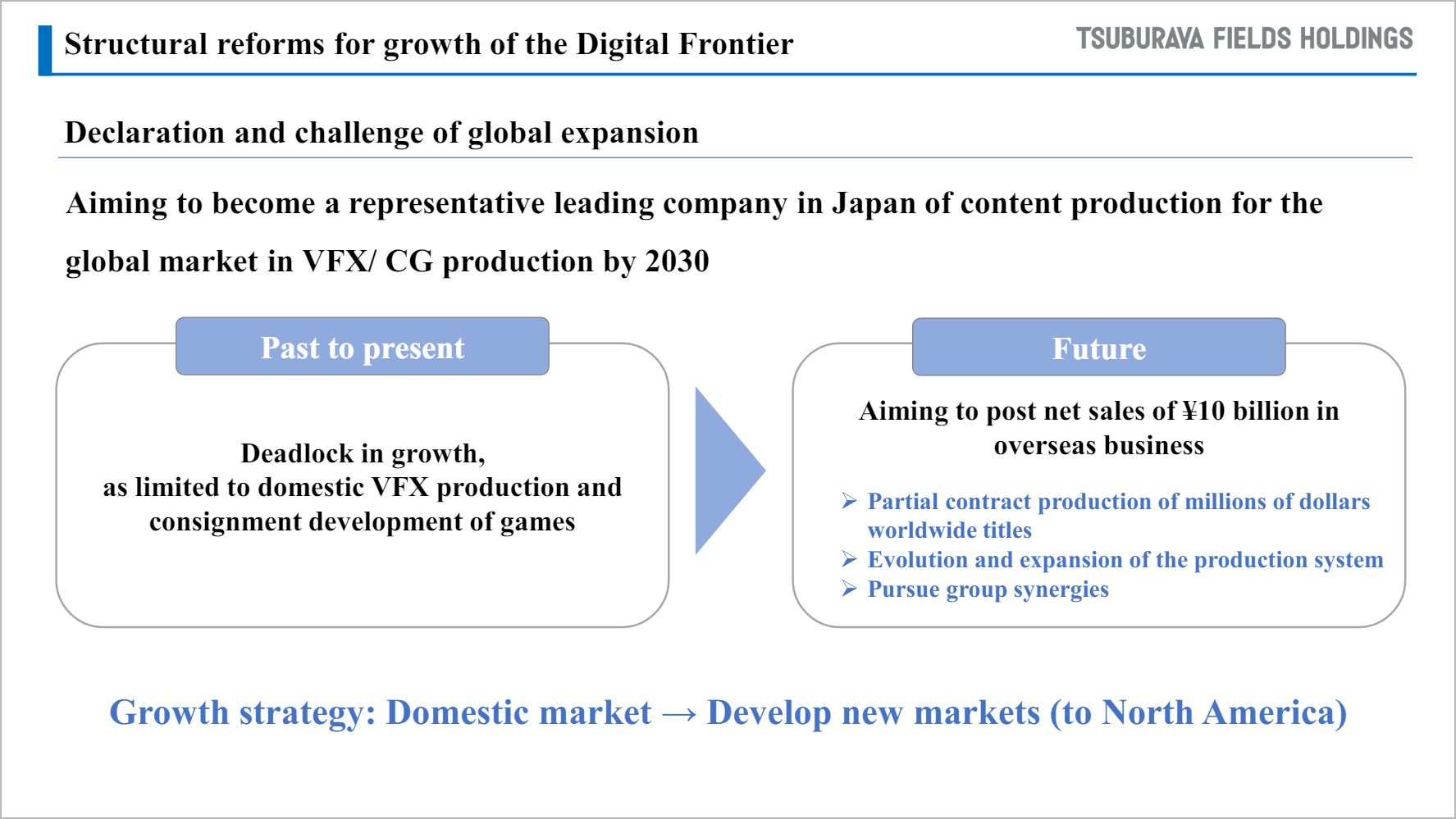

Structural reforms for growth of the Digital Frontier

Digital Frontier will work to restructure its business by developing new markets in North America and other regions and expanding its business globally, in addition to domestic VFX production and game-related contract development.

In the future, the Digital Frontier aims to reach net sales of ¥10 billion and become a Japanese-leading global content production company.

Content and digital business segment operating profit targets

The table below shows the operating profit targets for the contents and digital business segment. For the next fiscal year (FY 2024), the company plans ¥4 billion, taking into account aggressive investments for further global expansion.

Following thorough branding up to the next fiscal year, from FY2025 onward, the company plans to move into an aggressive phase from FY2026, with a target of ¥10 billion in FY2027.

PS business segment

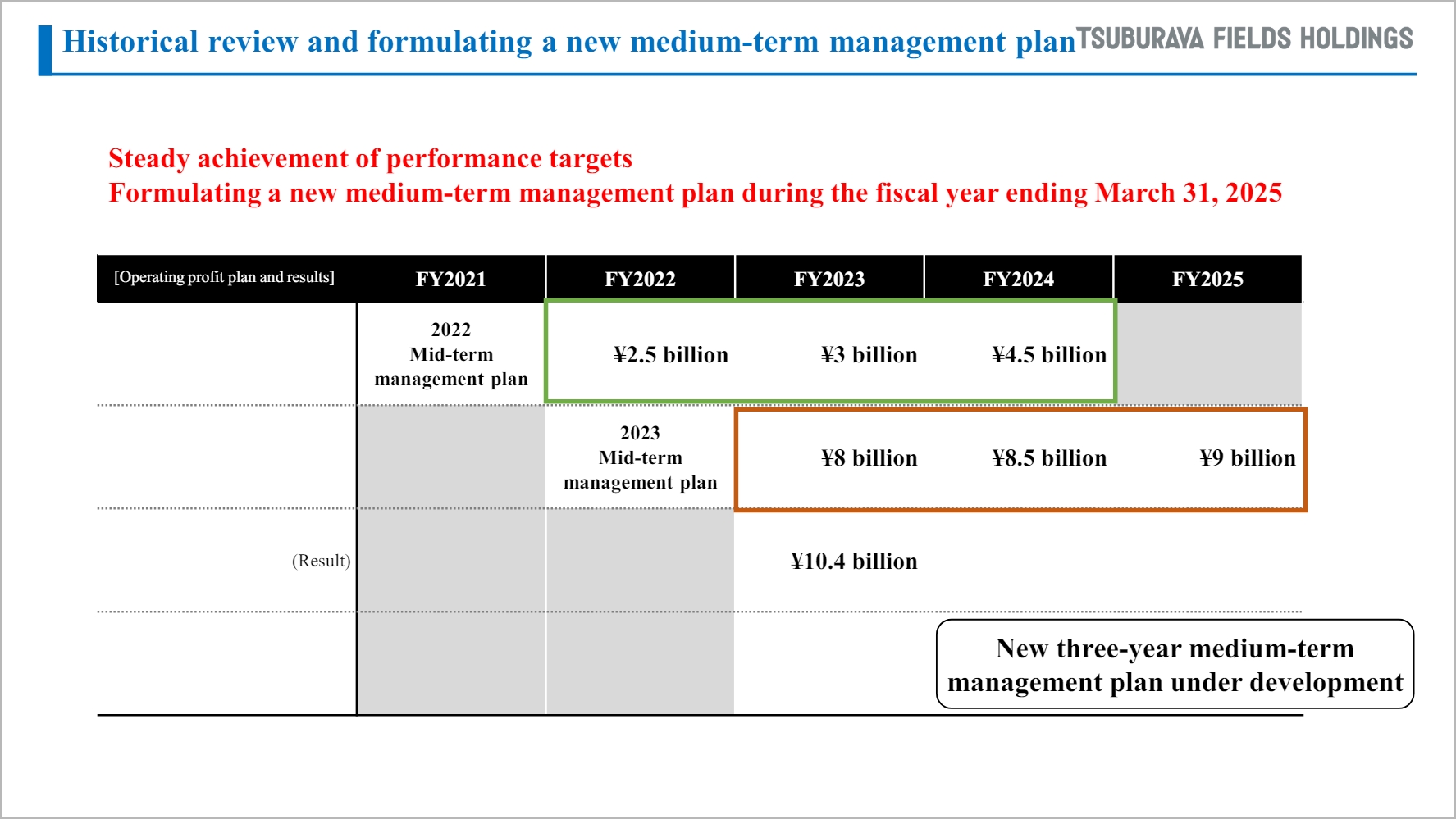

Historical review and formulating a new medium-term management plan

In PS business segment, we announced a new medium-term management plan (FY2023-FY2025) in May 2023, and steadily achieved its results in the first year.

In the future, we are preparing to announce a new medium-term management plan that takes into account current changes in the market environment and the making of Sophia group into a consolidated subsidiary. We prepare to announce the new plan within the FY2024.

The following is an overview of PS business segment for the FY2023.

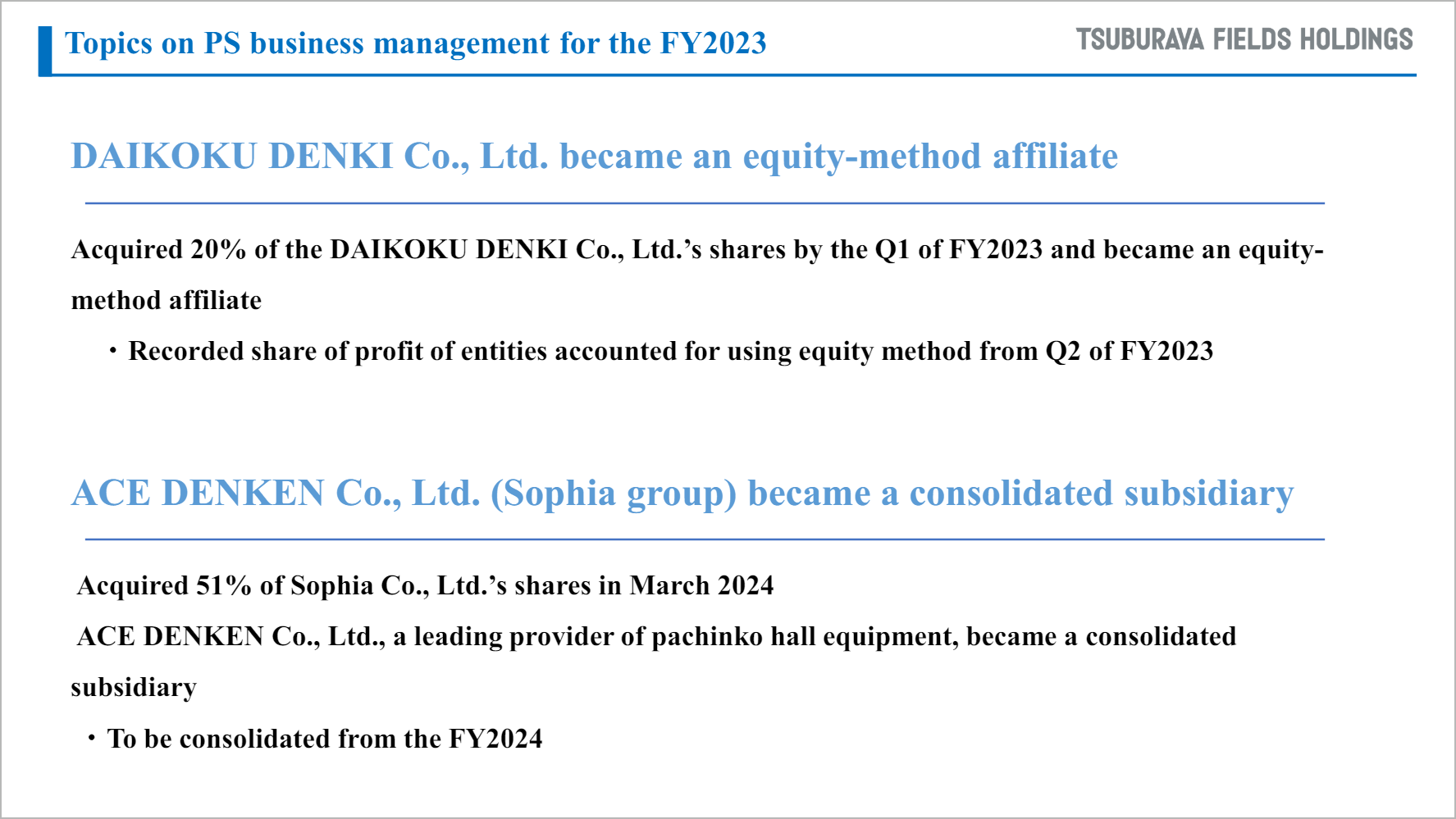

Topics on PS business management for the FY2023

1. DAIKOKU DENKI Co., Ltd. became an equity-method affiliate

We acquired 20% of shares in Daikoku Denki Co., Ltd., making it an equity-method affiliate. As a result, the equity in earnings of affiliates has been recorded from Q2 FY2023.

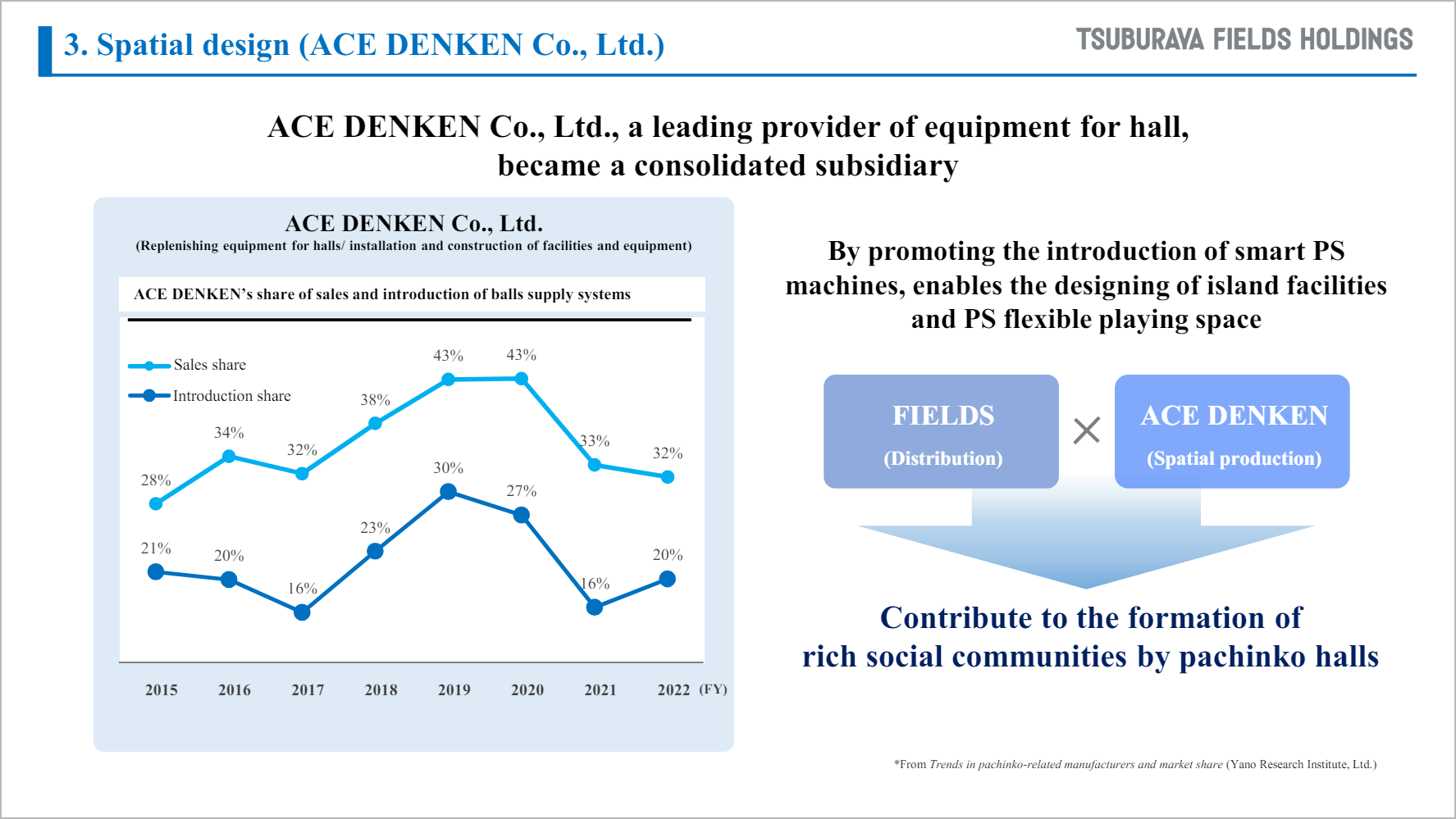

2. ACE DENKEN Co., Ltd. (Sophia group) became a consolidated subsidiary

At the end of March 2024, we acquired 51% of shares of Sophia Co., Ltd. and made ACE DENKEN Co., Ltd., the leading provider of pachinko hall equipment, a consolidated subsidiary.

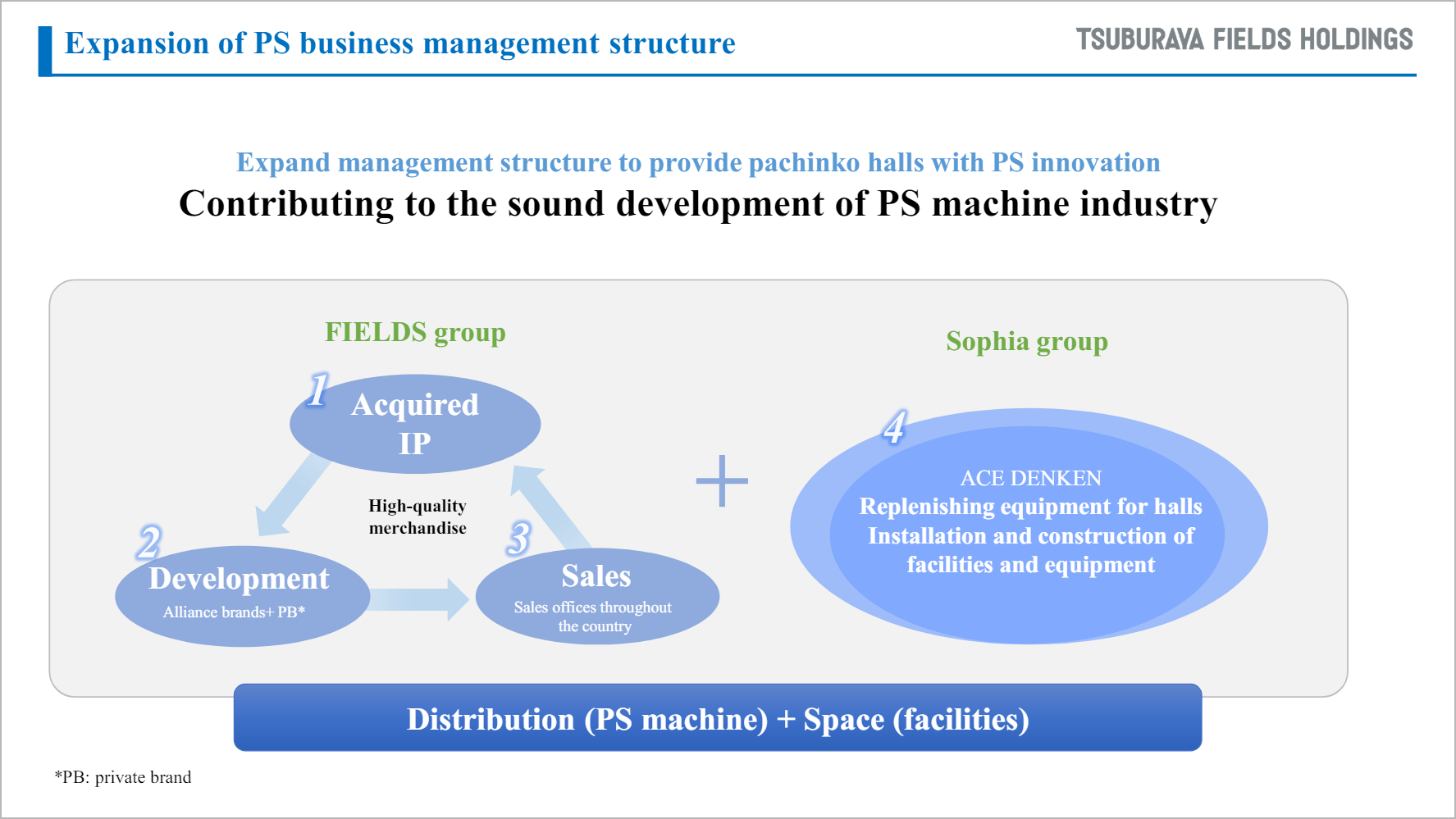

Expansion of PS business management structure

In PS machine industry, the introduction of smart PS machine has enabled free space designs for pachinko hall facilities and equipment, and PS machines. In the increasingly diversified leisure industry, pachinko halls are also needed to make major changes to contribute to the creation of a rich local community.

In the future, we hope to contribute to the sound development of PS machine industry by providing high-quality machines by FIELDS Group and producing comfortable game spaces by Sophia group.

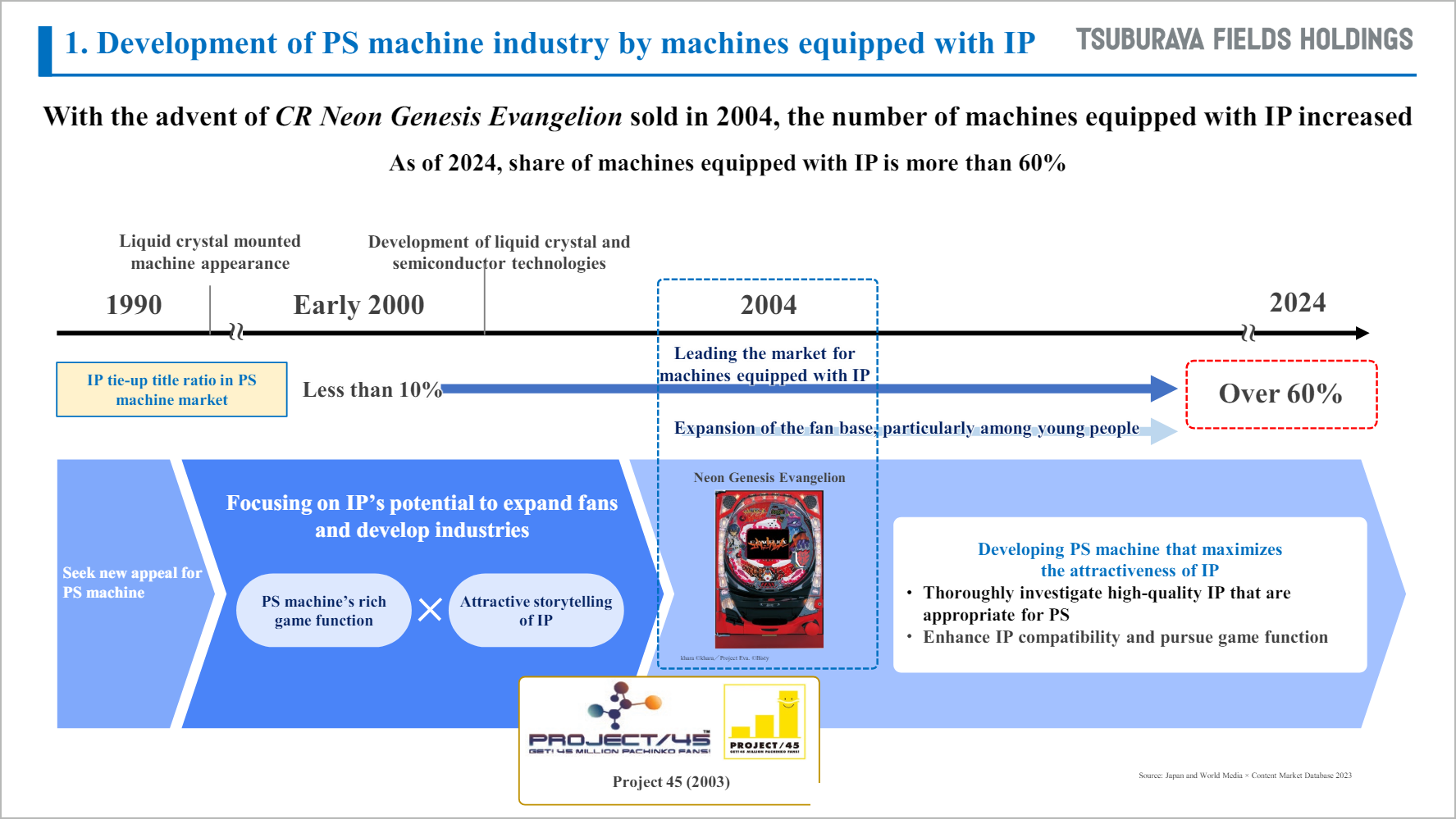

Development of PS machine industry by machines equipped with IP

We have been quick to focus on the importance of IP in developing high-quality machines and have conducted surveys and studies. Neon Genesis Evangelion, which was sold in 2004, was a pioneer in the field of machines equipped with IP, and contributed greatly to the expansion of a broad base, especially among young people, of all ages and genders. In order to deliver this kind of PS machines to our fans, we are investigating and acquiring high-quality IP that are appropriate for PS, and we are developing PS machines together with allied manufacturers to maximize their attractiveness.

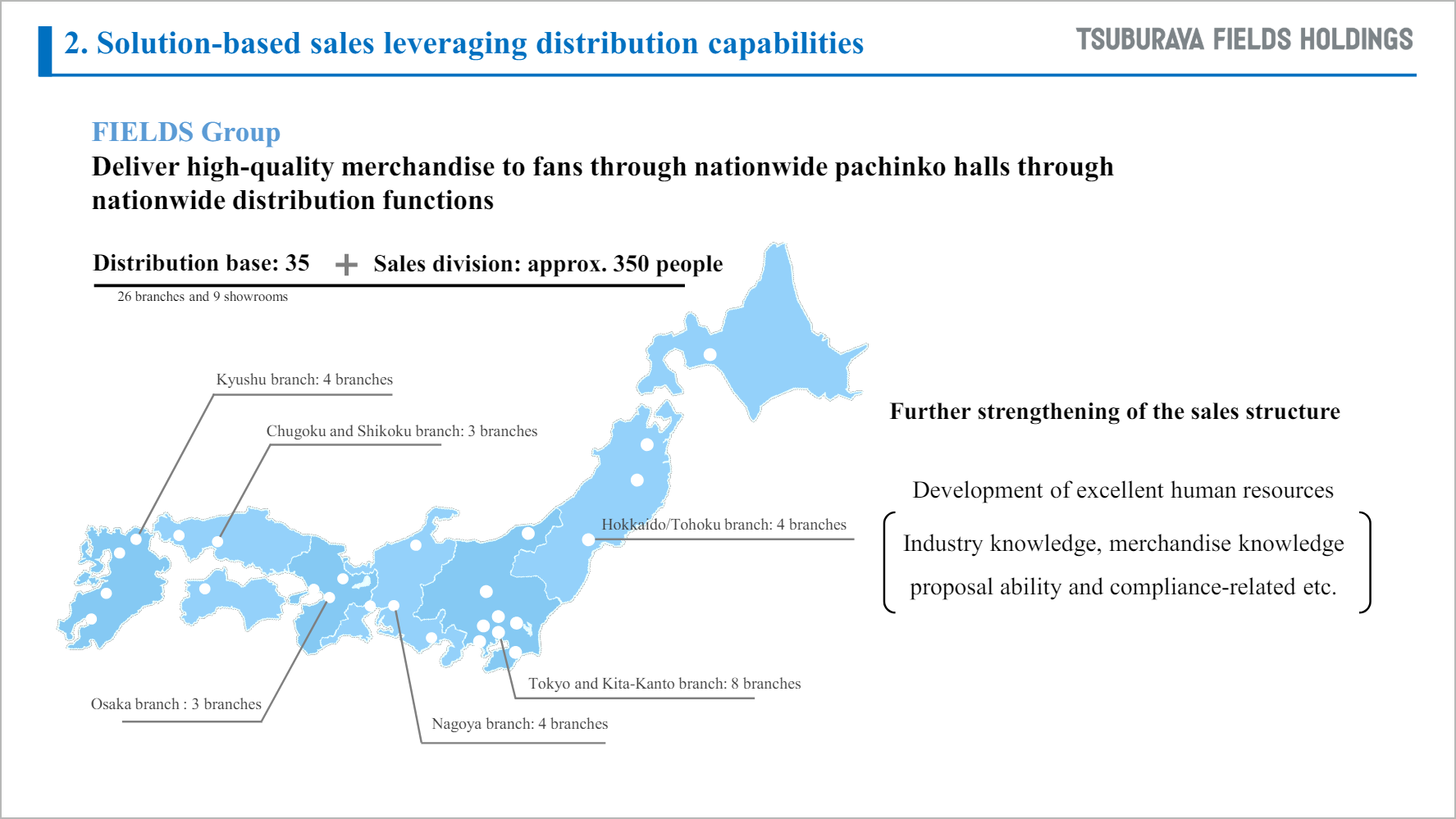

Solution-based sales leveraging distribution capabilities

FIELDS, the industry's only distributor, delivers the high-quality merchandises developed with allied manufacturers to our fans through our nationwide pachinko halls with our distribution capabilities.

In addition, the Company is further strengthening its sales structure, including the development of superior human resources, and delivering PS machine sales to pachinko halls nationwide, as well as information and solutions that contribute to daily management.

Spatial design (ACE DENKEN Co., Ltd.)

《Sophia group, which we acquired on Mar. 25, 2024》

Among Sophia group, ACE DENKEN Co., Ltd. is a leader in the installation and construction of pachinko halls supply equipment, and hall facilities and equipment. Now that PS machine and hall facilities and equipment can be freely designed in space by promoting the introduction of smart PS machine, we will contribute to the creation of a rich local community for pachinko halls by combining our strengths as a distributor of FIELDS with the strengths of ACE DENKEN as a producer of space.